Protecting Your Small Business From Employee Negligence

A deadly crash in Springfield, Missouri caused by a truck driver (an immigrant who was appealing an order of deportation by the Department of Homeland Security) raises anew the liability risks that employers face.

On Wednesday morning, March 28, 2013, the trucking firm employee, who was driving from California to Missouri, plowed into the back of a car sitting at a stop sign, killing both the driver and a passenger.

The truck was estimated to be traveling at 60 mph in a 40 mph zone. The driver of the truck was also in violation of the Department of Transportation ‘Hours of Service’ regulations for over-the-road truck drivers to prevent accidents caused by fatigue. According to the driver’s log books, he had driven more than 70 hours in the past 7-day period without a break, in direct violation of DOT regulations for continuous days of driving.

Why Business Owners Should be Concerned

Employers are liable for the acts committed by an employee during the course of his/her employment per the legal doctrine of ‘respondeat superior.’ While this doctrine has been around for centuries, in common law, the startling rise in accidents by illegal immigrants has created a new sense of urgency for business owners to ensure that their assets are protected and are not put at risk by a negligent employee.

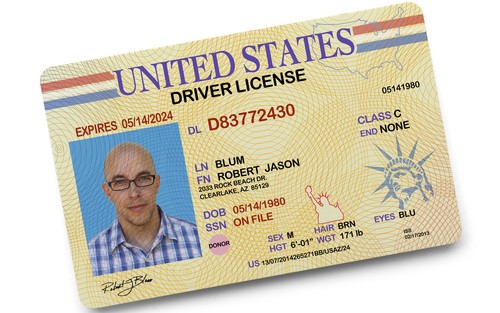

Employed, Illegal and Lacking a Valid Driver’s License

A report by the Department of Homeland Security surprisingly found that 47% of drivers cited and/or stopped in California have no license, no insurance and no registration for their vehicles. Of that number, 92% were illegal aliens. A similar study in Arizona found that 63% of those cited and stopped in Arizona did not have a valid license with 92% of total found to be illegal aliens. A study by AAA found that unlicensed drivers are five times more likely to be involved in fatal crashes.

While Washington debates the public policy on how to resolve the issue of illegal immigrants—estimated to be 12 million by the Center for Immigration Studies and between 7 to 20 million by CNN, the cold reality is that the majority of these illegal immigrants are employed within the United States. Courts and juries have, yet, to establish clear legal standards for business owners to check both the immigration and driver’s license status of each of their employees, before letting them get behind the wheel of a company vehicle.

What the courts and juries demand from employers will only evolve through litigation in several different states, leaving business owners at risk until this newly emerging law becomes settled. No business owner should allow himself to put his assets at risk, as the legal standards are developed as a by-product of litigation, when simple straight-forward asset protection strategies can be put in place, today.

Distracted Drivers

Additionally, a recent $21 million jury verdict against a leading beverage manufacturer, whose distracted driver struck a woman pedestrian, is certain to usher in a new wave of ‘distracted driving’ jury awards, in the years ahead. This is a given, especially in light of the universal use of cell phones as a way for supervisors to connect with their employees who are away from the business performing their duties. A similar jury award against a small business owner would deplete all of his assets.

Over the years, we have found in our business analysis reviews, a pervasive lack of awareness on the part of business owners of the risks, which they face, with their drivers. It is common that business owners are under-insured in regards to both their business and personal assets, which are poorly protected from the risks of negligent employees.

How Great is the Risk?

When just one jury award, like the $21 million judgment cited above, can wipe out a lifetime of hard work for a business owner, there is no good reason to wait to implement an asset protection strategy. No business owner should put the entire financial security of his family at risk, no matter how small that risk may be.

Employer liability for injuries in vehicular accidents has expanded significantly in the 39 states that have recently enacted statutes prohibiting the use of handheld cell phones for making calls, or texting, while driving. The Department of Transportation has also issued similar regulations for truck drivers, nation-wide. The risk to business owners from this new wave of laws and regulations has yet to be established in the courts and by juries. Given the unknowns of this new area of tort litigation, the only prudent response for a business owner is to develop an asset protection plan with competent legal experts.

Recent studies involving workers compensation claims have found that over 200,000 employees are injured as a result of distracted driving accidents. This is just the tip of the liability iceberg, because it only involves worker compensation claims by employees and does not even begin to quantify third-party claims, which are not reported to state agencies in the same manner as worker compensation claims.

The employer liability for ‘serious and willful misconduct’ for injuries to employee passengers who are riding with an employee accused of distracted driving are also uninsurable under most state worker compensation laws, exposing the business owner to further risk. Few business owners are even aware of this exposure, as it is common for employees to drive other employees to job sites and on other company business.

Like any new area of the law, which has yet to be fully developed, no one truly knows how the courts will expand the liability for distracted driving by employees. Moreover, no one can predict in the coming years the boundaries for juries, who have the power to award both compensatory and punitive damages for distracted driving and the resulting accidents by illegal immigrants employed by businesses. If the public ire over distracted driving continues to gain momentum, it will surely spill over to the people making up tomorrow’s juries.

Plaintiff attorneys will no doubt seek to have someone pay dearly when a business owner fails to exercise due diligence in the verification of illegal immigrants who are not licensed to drive in their state. Juries will not look with favor upon business owners who wanted the benefits of cheap labor at the expense of holding people accountable to be responsible, licensed drivers, on our public roads.

When someone is seriously injured, plaintiff attorneys are always looking for someone to pay. When you add in the opportunity for a plaintiff attorney to spin a tale to the jury about how the injuries to his client could have been avoided, had the business owner been more diligent in checking the driver’s licenses of his employees, juries will be much more sympathetic to the injured victim. Juries may also want to teach a lesson to other business owners by awarding a large punitive damage award, which the law allows, to deter similar behavior by other business owners.

Protection for Business Owners

The only way for a business owner to protect his assets, from the unforeseen expansion of his legal liability for both the illegal immigrants that he may employ and the jury awards for accidents from distracted driving by one of his employees, is to bring in a team of legal experts who can build the firewall between his assets and a lawsuit seeking a judgment against everything that he owns.

While asset protection planning may seem like it’s a back burner issue, which can be dealt with some time in the future, the cold reality is that no business owner should ever put his assets at risk by failing to plan.

Now, is the time to move the pot of assets from the back burner, to the front burner, with a professionally designed asset protection plan.