Irrationally Rational

If we are going to turn these economic times into an opportunity, maybe we need to be irrationally…rational.

As a business owner, you currently find yourself in trying times. As such, do you bury your head in the sand and hope the storm will blow over, or do you take action and try to turn it into an advantage? If you plan to turn these economic times into an opportunity, then you must be willing to take a sober look at the playing field you find yourself on and how you have been conducting your operations. You must be willing to change many of the habits and ideas that form the foundation of who you are and what you do as a business owner.

Many small- and mid-sized business owners have already had to close up shop, and many more will do the same in the coming months and years. So, statistically speaking, many of you must make wholesale changes to how you do things in order to simply survive. When looking at the numbers, this is the only rational course, but as someone who has formed several businesses of my own, I know that individuals don’t always take the most rational approach to their business lives.

Chances are, some of the people closest to you implored you not to go into business for yourself telling you how much of a risk it was. However, in spite of your own fears, and the fears of your family and friends, you did it anyway. It might not have been rational, but you did it because, as an entrepreneur with an entrepreneurial spirit, you knew you would find a way to make it work, and for the most part you did. America was built on this type of irrationality.

The problem is that you now find yourself in a “once in a multiple generation” financial tsunami. In the past, you were always able to find a way to at least do well enough to take care of your family and employees, even in the tough times. Occasionally, you were even able to use some of the profits of a successful year to purchase a few of the toys you wanted in life. This time, however, the economic trough is so low that your ability to continue business as usual is in serious question. There is a limit to everything, and it may be too irrational to assume that if you simply keep your head down and work hard, you can ride out this storm without having to actually do the real work of refocusing and reengineering your business.

However, for my gloriously irrational fellow entrepreneurs who believe they can simply ride this out without making any real changes, I tell you this. Many years ago, I had the opportunity to travel abroad to Japan. While I was there, I took a tour of a Buddhist temple. On the front of the temple was an engraving that said something to this effect:

“There is nothing you must think.

There is nothing you must say.

There is nothing you must eat or drink.

There is no place you must go.

There is nothing you must learn or gain.

There is nothing you must do.

It is helpful to remember, though,

that when it rains, the earth gets wet.”

If you are irrationally convinced that you do not have to change the way you think about your business, the way you set your priorities and focuses, then good for you. The world was built on the irrational drive of the courageous. However, it is important to keep in mind that, “when it rains, the earth gets wet.”

It seems as though contradictory thoughts are being presented here, such as: “Everything really great was probably started from someone being irrational,” and “The irrational will not likely survive this crisis.” Therefore, what is the answer? Maybe you need to be irrationally rational.

At times during this crisis, it seems as though there is no way through, no way to get out of it with your business intact, no way to hold it together, and there are no indicators saying anything is likely to change anytime soon. In these times, that irrational entrepreneurial spirit that drives you must be called on to completely and utterly convince you that in spite of all the rational evidence to the contrary, you will survive and thrive. But once you have called on this irrational spirit, you must take a rational approach to making it happen, irrational rationality.

In the previous issue’s article, we looked at the playing field. Here, we will determine how you play in this environment. First, we must focus on the thought processes through which you view and prioritize the functions of your business. If the way you think does not fit the economic environment, how can your actions and strategies follow?

To understand this concept, it helps to first comprehend the notion of the thought paradigm. A thought paradigm is the prevailing pattern of thought processes that shape the way you prioritize your life and decision-making actions. For example, let’s say you have an evangelical Christian on the right and a scientist on the left. Their thought paradigms are the lenses through which they see and interpret their world. Their separate thought paradigms cause them to react and prioritize their lives and actions in very different ways.

When I begin working with small- and mid-size businesses, there is one of three prevailing thought paradigms that drives the decisions and strategic focuses of ownership and management. The first is what I call the sales paradigm. Relatively new business owners believe that the way to building wealth and security in his or her business is to focus on and drive sales. These owners are sales centric in their approach to business.

When they gain further experience, they realize that generating sales doesn’t make them rich or secure, as they learn very quickly that sales do not necessarily equal profits. Once they gain additional experience, they move over into the profit paradigm—their focus and strategy sessions, or their priorities, now switch to focusing on generating profits. Whatever way you try to do it, either by managing costs more efficiently or increasing prices or both, you now become profit centric.

You then learn very quickly that you can price a great deal of profit into your operations, but now you have priced yourself out of competition for clients and are not getting enough sales. What good are high profits on sales you don’t make, or high sales without enough profits to have a sustainable business?

You then move to the third and most common thought paradigm in business, the sales and profit paradigm, where you try to sustainably generate profitable sales. You are now sales and profit centric.

Your goal in this economic environment should be to move into a fourth thought paradigm, the cash paradigm, because when you decide that you are ready to start building real wealth, real liquid net worth from your business, you learn that sales and profit on paper do not necessarily equal cash in your bank account, and cash is king in any business. Why is cash king? Because you cannot pay yourself with sales on paper, you cannot pay yourself with accounts receivable, you cannot pay yourself with inventory, you cannot pay yourself with quality employees or equipment or any of those other factors you want to have in your company. You can only pay yourself with available cash. In addition, you can only grow your business with cash and perhaps, most importantly, it is cash that will sustain you when times are tough. Looking at your business strategically through the lenses of the cash paradigm causes you to shift your historic priorities and decision-making drivers.

In his book entitled “Cash Rules: Learn & Manage the 7 Cash-Flow Drivers for Your Company’s Success,” Bill McGuinness puts forth an outline for strategic cash flow management that we will loosely follow. We will also include an eighth cash flow driver: strategic tax and asset planning.

The eight drivers of cash flow are:

Primary Drivers

- Sales Growth

- Gross Margins

- Overhead Costs

Swing Drivers

- Accounts Receivable

- Accounts Payable

- Inventory

Competitive Drivers

- Capital Expenditures

- Strategic Tax and Asset Protection

The first and most important driver of all is sales growth. Every business has what is referred to as a “sustainable rate of growth.” If you grow faster than this, you go bankrupt from the cash demands of the growth. If you grow slower than this, you are not living up to your own businesses potential and are losing sales that you should be making.

For example, imagine you are in a long-distance rally car race from Maine to California. Fuel management becomes very important. The more pressure applied to the car’s accelerator, the faster the car goes; however, the car is also burning fuel more rapidly. How much pressure must be applied to the accelerator in order to get you to the finish line ahead of the pack and not leave you stuck on the side of the road out of fuel, bankrupt? Once you know this number, you need to get ahead of the pack by implementing quality sales systems and processes.

The foundations for effective sales engineering are the same in almost every industry. You cannot simply hire salespeople or estimators and instruct them to sell and hope to beat out your competitors in this economic environment. You must use the numbers, not educated guesses, to predetermine the day-to-day efforts of your sales generating staff and then predetermine what their results should be. You, or a trained executive, must do this for them—they cannot do it themselves. It is important to set these targets for them and yourself because if you aim at nothing, you can be sure to hit it every time.

Once you have set numbers, driven detailed targets for both the efforts and the results of your sales processes, you must make sure to have timely, effective and accurate means of tracking the actual efforts and results against the predetermined standards. It is important to remember that what you can measure you can control, but what you cannot measure you cannot control.

Simply hiring sales personnel will not provide you with consistent results. Think of these factors as the foundation of your sales house. If you do not begin with a solid foundation, what kind of house will you end up with?

The second cash driver is gross profits. Your gross profit is the fuel economy your engine gets in the race. Does your engine get 15 mpg or 45 mpg? If it gets 15 mpg, then perhaps the car has a great deal of horsepower. Low prices that cut your profits will speed up sales, causing the car to go faster, but with low gross profit contributing to cash flow, you may run out of fuel before reaching the finish line.

If you have a 45-mpg engine, then you have a very fuel efficient car that leaves a significant amount of fuel in the tank; however, it doesn’t go very fast. If you have so much gross profit built in that your pricing fails to be competitive, you will not finish ahead of the pack at the end of the race. You must find the correct balance between generating significant amounts of sales with little profit or few sales with substantial profit.

The third driver of cash flow is overhead, or Selling, General and Administrative Expense (SG&A). This is similar to a car’s aerodynamics or the setup of its transmission. These are all of the factors that affect the fuel economy or cash efficiency of your car aside from the actual engine itself (such as payroll, admin, etc.). It is important to utilize the correct gauges and instruments in order to analyze your overall performance in the race. Rolling cash flow forecasting reports and budgeting tools, as well as the ability to obtain timely and accurate information regarding where you are and where you want to be, are just a few examples of these necessary instruments. These tools should be implemented with maximum ease of operation and cost controls.

- Get the right expectations with the client from the beginning as to when you will be paid, how you will be paid, what the penalties for late payments will be, what the rewards for early payments will be, etc. Also, make sure to inform every client that you will enforce your credit granting policies at all times. A clear understanding of these policies at the start of a new relationship with a client makes everything a lot easier when it comes time to get paid.

- The second area in which your sales processes affect accounts receivable (A/R) is in generating enough sales opportunities to say no to the clients that do not want to pay you on favorable terms. If your sales processes are creating a line at the door, you can say no to the clients who cannot or will not pay you under the terms you choose and still have all the sales you need. With no sales systems creating a line at the door, your clients dictate your credit terms.

The next driver is accounts payable (A/P). This is the opposite of accounts receivable. You want the average time you are taking to pay out on A/P to be as long as possible. Increasing the amount of days you are able to pay is similar to siphoning fuel from your vendor’s car into your car so you can run the race better, faster and stronger.

Many business owners may view the relationships they maintain with their vendors and clients as partnerships. However, these partnerships do not extend into each business’ respective A/R and A/P departments as your A/R department wants to receive fast payments, while your vendors’ or clients’ A/P departments want to pay slowly. This battle is one for survival, as the lifeblood of any business is cash. Whichever business has the most successful strategies, systems and processes managing these drivers is the winner of the fight. As a business owner, you must have the desire to win this fight by being aggressive when collecting and paying.

The next driver is inventory. The amount of cash tied up in inventory should be as low as possible. Increasing inventory is similar to taking fuel out of your racecar, putting it in a 55-gallon drum and burying it behind your vacation home. The fuel is still yours; however, it is not readily and economically available. There is a cost associated with carrying inventory—the longer you carry it, the more it costs. There comes a point at which keeping inventory on hand for too long, for whatever reason, means that you have spent so much money carrying the inventory that you cannot make any profit from it.

To better understand the importance of cash drivers, we need to understand the difference between cash generation and profit generation.

When a business has more sales coming in than expenses going out, there are profits. Remember, profits are about amounts of money. However, cash flow is different. With cash flow, it’s not so much about the amount of money that is coming in or going out, it’s about the timing and speed at which the money is flowing in and flowing out. Cash flow is about the timing of the flow of money as much as the amount.

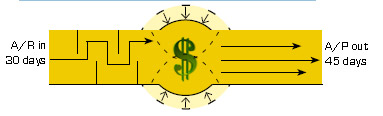

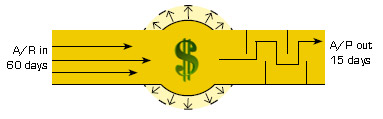

For example, imagine two separate pipes. Water is flowing in through one pipe and out through the other, and the two pipes are connected in the middle by an expandable balloon. So, the water flows in one pipe, through the balloon, then out through the other pipe. The water flowing through the “in pipe” is your A/R, and the water flowing through the “out pipe” is your A/P. The water in the balloon that connects the two pipes together is the cash retained in your bank account at any given time.

What happens if you increase the speed at which the water is coming in (for example, move receivables from 60 days to 30 days) while decreasing the speed at which the water flows out (moving A/P from 15 days to 45 days)? The balloon, or your bank account, swells, and the retained cash in your company increases.

On the other hand, if you collect at a slower pace than you pay out, you create a vacuum in the balloon that will eventually cause the balloon, your bank account, to collapse and pinch off the supply of cash flow, causing you to go bankrupt. This pinching off of cash flow happens more quickly if you accelerate sales without quality cash flow planning and controls.

The next two drivers of cash flow are referred to as competitive drivers, as they are the drivers that give you an edge over the competition. The first of the competitive drivers is capital expenditures. Think of capital expenditures as the adjustments you make to your racecar to make it better than the other cars in the race. What improvements are you implementing to make your business more competitive? Maybe it is new vehicles, computers, software or equipment updates. Maybe it is bringing in new staff or hiring consultants or trainers to improve the efficiency and productivity of your current staff. Making no capital expenditures hurts cash flow, as the other cars in the race are constantly improving. If you are not, you can eventually drop out of the race altogether.

The second of the competitive cash flow drivers is strategic tax and asset planning. Think of this driver as a top notch, highly skilled pit crew that is providing you with support in the areas of the race that you cannot manage from inside the car.

The pit crew makes sure you are minimizing and deferring tax payments as much as possible without creating penalties, while making sure that if you have an accident, you do not find yourself unexpectedly knocked out of the race. Strategic tax and asset planning is similar to the safety systems in your car that keep you from losing everything if you get into an accident. Consider how much more competitive your business could be if you set up the playing field in a way that allows you to reduce your taxes by 25 percent to 35 percent and push the payment of the reduced amount out for up to two years without significant penalty. How would this benefit cash flow?

If you view all of these cash flow drivers from the perspective of cash flow production, you tend to make different strategic decisions than you did when you were solely focused on sales and profit. For example, in order to collect A/R faster, you tighten your credit granting policies. The more you tighten your credit policies, the more sales you lose. To get a portion of these sales back, you could, for example, reduce profit margins to reduce pricing, thereby encouraging certain clients to pay more quickly. However, you may lose a small amount of profit because you are not receiving prepayment discounts on your purchases, or because you are reducing cash tied up in inventory by not buying at bulk discounts that are not sensible from a cash flow perspective.

These actions are strategic moves that reduce both your sales and profits. They may not appear too attractive if you are operating from a mindset that is driven by sales and profits on paper instead of actual cash in your bank account. But, is it better to finish the year with $5 million in sales with 10 percent net profit and $50,000 cash in the bank, or is it better to finish the year with $4 million in sales with seven percent net profit and $350,000 cash in your bank account?

The answer here should be obvious—either you pay taxes on a substantial amount of profits that you cannot actually pay to yourself because there is no cash in the bank to do it with, or you pay taxes on a lower amount of profits, but are able to pay yourself because there is cash in the bank. There are many ways to strategically win the battle for cash and survival in your business, and you must find the approach that works for you. However, be aware of the rules of the new game you are in and the new playing field you are on.

We may have two to three more years of economic struggles ahead of us or we may have a decade. We may have periods of false starts that are, in reality, just a lull in the storm. But one thing is certain: many businesses will not survive. The ones that do survive and thrive will have climbed Mount Everest; so, it might be helpful to learn some lessons from the actual mountain climbers that attempt Everest. First, they are irrational. They convince themselves that they will be amongst the very few who actually accomplish scaling heights that the human body is not built to survive. But the ones that actually make it to the top only do so by acting on the irrational in a completely rational way. Every step up the mountain is strategically planned and engineered. Every part of the plan is researched, studied and evaluated. Every step taken is within the plan. There are adjustments for weather and other variables that cannot be known ahead of time, but the flexibility to deal with these issues is built in as well. If the climbers become overwhelmed technically or logistically, they rely on their Sherpas—just as you have consultants and outside experts available to you.

If you want to get up this mountain, what are you going to change about your day-to-day operations? What kind of strategic planning and implementation are you willing to apply to get to the top? Are you willing to work hard and smart at the same time? Are you ready to be fearlessly irrationally rational?

If the answer is yes, then you are one of the foundation stones upon which greatness is built. You take action instead of waiting for the situation to change on its own—you are not a victim of a financial tsunami; you are the solution.