EBITDA

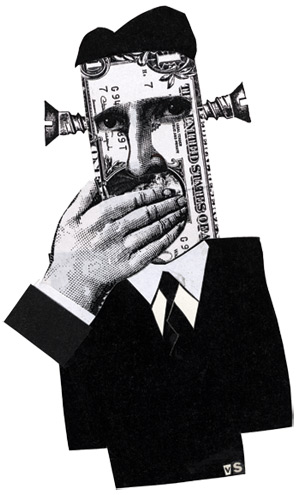

EBITDA – Frankenstein math for the naive and uninformed.

EBITDA – Frankenstein math for the naive and uninformed.

EBITDA is not the “be-all and end-all” it’s purported to be. In fact, when applied as a single measure of financial performance or value, EBITDA has many inadequacies. Naive and uninformed individuals indiscriminately use EBITDA for whatever purpose they desire, and worse yet, they use deceptive accounting techniques to create mathematical monstrosities as a substitute for sound financial analysis. These individuals do not understand EBITDA’s two basic deficiencies: 1) EBITDA does not equal cash flow; and 2) EBITDA is not a standalone multiple of valuation analysis.

What is EBITDA?

EBITDA is an accounting metric that is literally translated as Earnings Before Interest Taxes Depreciation and Amortization, and is calculated commonly as either Net EBITDA or Operating EBITDA.

Net EBITDA = Net Income + Taxes + Interest Expense + Depreciation/Amortization Expense.

Operating EBITDA = Net Operating Profit + Depreciation/Expense {extraordinary items, interest income, gains and/or losses and non-operating income and/or expenses may (or may not) be ignored}.

Unfortunately, EBITDA is not a measure of financial performance calculated in accordance with generally accepted accounting principles (GAAP) and therefore, there is no general consensus as to its official calculation. As mentioned, the computation of earnings is discretionary as it may or may not include non-cash expenses and non-cash revenues. To further complicate matters, differences in accounting methods and a company’s accounting policies also make a consistent application of EBITDA among all companies, all industries, all reporting periods and all circumstances nearly impossible.

EBITDA’s fame emerged during the 1980s and 1990s, when it was used to evaluate the cash flow of companies in a low-credit or near-bankruptcy position. Also, during the 1980s it was a tool LBO (leveraged buy out) sponsors and lenders utilized to measure a company’s ability to service debt. The theory was simple: if both capital expenditures and repayment of principal can be delayed, and if working capital is not needed for expansion, then the entire EBITDA amount can be given to lenders to pay interest.

Sponsors compiled aggressive financial projections based on this theory. Postponing unimportant expenditures was expected for financially distressed companies; however, to add depreciation expense to earnings to service interest payments is only rational for short periods of time. Eventually, repairs on equipment must be made and new purchases must replace obsolete equipment. Further, for growing companies, the amount of annual capital expenditure is likely to exceed depreciation expense as the capacity must grow to meet demand.

The frenzy of the media acquisition bender was fueled by creative EBITDA calculations beginning in the early 1990s by big name players such as Time, Inc., Warner Communications, Viamcom and CBS. Following soon after were the WorldCom and Enron accounting scandals in 2001 and 2002. The sequence of these and other similar events began to shake investors from the EBITDA trance. Not so intently were they listening to Wall Street analysts and corporate managers who continued to speak of allegedly healthy companies with sexy EBITDA margins and therefore ample cash to service debt obligations. Investors came to see the reality: EBITDA is not a valid indication of the investment’s cash flow, cash position or value. The EBITDA calculations resembled something more along the lines of “Frankenstein math” than thoughtful analysis, and put several large investing companies that ignored the warning signs into serious financial trouble.

The Kroger Co., a well-known retail grocery chain, is also guilty of creative EBITDA calculations—this time to award annual bonuses for the chief executive and other top officers. A March 2002 article published in the Wall Street Journal Europe reports that for many boards of directors like Kroger’s, EBITDA increasingly is becoming a factor in compensation decisions even though the metric has no particular meaning. In other words, “EBITDA means what a company wants it to mean,” and in Kroger’s case, shareholders get shortchanged because although EBITDA is almost always a positive number, simultaneously earnings per share can be negative.

1) EBITDA does not equal cash flow.

As if distorting EBITDA with creative accounting to make a company appear more profitable than what it really is isn’t bad enough, there are those who try to substitute this inept calculation for cash flow. Cash flow calculations consider working capital requirements for growth, income taxes and the purchase and funding of new equipment. EBITDA clearly omits these fundamental factors and misrepresents a company’s financial reality.

Moody’s Investors Service published a special comment report in June of 2000 on the “Ten Critical Failings of EBITDA as the Principal Determinant of Cash Flow.” In brief, this frequently quoted and wellrespected report points out:

- EBITDA ignores changes in working capital and during periods of working capital growth needs.

- EBITDA distorts a company’s liquidity.

- EBITDA does not consider reinvestment of machinery and equipment, especially those companies with short-lived assets.

- EBITDA says nothing about the quality of a company’s earnings.

- EBITDA is an inadequate standalone measure as an acquisition multiple.

- EBITDA ignores distinctions in the quality of cash flow resulting from differing accounting policies.

- EBITDA ignores differences between U.S. GAAP (generally accepted accounting principles) and foreign (non-U.S.) GAAP.

- EBITDA offers limited protection when used in certain loan covenants.

- EBITDA does not resemble reality.

- EBITDA ignores unique industry attributes.

This last point is especially troublesome for those companies in industries that require frequent upgrading or replacement of equipment. EBITDA is not a substitute cash flow calculation for companies with expensive, short-lived assets (five years or less) that need continual replacement or have intense working capital requirements. In general, EBITDA falls short of considering the specific financial and operational attributes of industries, such as manufacturing, rental equipment services, trucking and transportation, and construction.

Manufacturers must replace and/or repair equipment frequently and therefore EBITDA is not an appropriate measure of cash flow for these companies. A thorough analysis of a manufacturing company will always consider the age and condition of the equipment. Maintaining state-of-the-art CNC and computerized equipment keeps these companies competitive. New equipment purchases dictate heavy depreciation expense; these purchases are likely financed, as well. Manufacturers also have steep working capital requirements to fund current and future contracts. A typical manufacturing company can have a healthy EBITDA of 10 to 25% of sales. However, depreciation and interest expenses may greatly depress pre-tax income.

The American Rental Association divides equipment into three broad categories: 1) construction and industrial equipment; 2) general tools, including do-it-yourself equipment; and 3) party and event equipment. Rental equipment companies can be very lucrative, with EBITDA’s of 20 to 25% of sales. However, the demands of replenishing the fleet can be very capital intensive and a substantial portion of earnings must be reinvested. Additionally, these purchases tend to be financed, and therefore, EBITDA is not representative of cash flow as it does not take into consideration the depreciation expense and interest payments required to keep rental equipment “attractive” and current. Rental service companies can temporarily delay reinvesting depreciation if the equipment is fairly new. Nevertheless, this cannot last for any lengthy period of time. If the rental services company engages in used equipment sales, then EBITDA can be affected by the volume and timing of those sales as well.

Trucks, tractors and trailers are all short-lived assets, meaning the equipment is depreciated over five years or less. Therefore, for many small to medium-size trucking and transportation companies, depreciation expense can quickly deplete profitability and make for very “skinny” pre-tax earnings. Further, the rolling stock is typically financed over the depreciable period. Taking into consideration the sizeable depreciation and interest expenses a trucking and transportation company will have on annual basis, EBITDA is not a realistic substitute for cash flow. Maintaining the transportation fleet is imperative for transportation companies, not only to be competitive but for licensing and insurance requirements. The fleet must be replaced and/or repaired frequently and depreciation should be utilized for reinvestment in new equipment. Depending on the size of the fleet and annual revenue growth, annual depreciation and interest expenses are on average stable from year-to-year. If investment in new equipment is delayed due to the company’s inability to service debt, maintenance costs can quickly skyrocket out of control which will further reduce the company’s ability to keep existing clients or gain new contracts. At that point, management will have their hands full trying to keep the company from going under.

Construction companies can be very profitable businesses, however those that struggle do so because they lack working capital. Like manufacturers, the working capital requirements of construction companies can be sizeable; these are financial demands EBITDA does not capture. General contractors in new building construction, especially residential builders, make few high-dollar capital expenditures; therefore, minimal depreciation expense is reported. However, general contractors typically purchase land, which takes time for approval to build and develop. In most cases, the purchase is heavily financed and interest associated with the development of land may be classified as a cost of goods sold (versus amortized as an expense). To look at a meaningful measure of a construction company’s interest coverage EBITDA should be adjusted for the amount of interest that is amortized through cost of goods sold. Nevertheless, based on the steep working capital requirements, assuming EBITDA is representative of the company’s cash flow position is erroneous.

2) EBITDA is not a standalone multiple of valuation analysis.

Market multiples are derived from transactions by dividing earnings or a particular financial metric, such as revenue, gross profit or other level of earnings by a business’ stock price or actual purchase price. Quite literally, almost anything can become a multiple derived from a purchase price. During the dot.com era when the market was booming with unprofitable start-up Internet companies, the acquisition of these companies was based, in part, on a multiple of sales or as a multiple of clicks or hits. Therefore, by default, a pricing multiple is created by backing the particular variable into the purchase price, as shown:

When buyers and sellers come together in a transaction, they typically don’t base the purchase price on an EBITDA multiple exclusively. The EBITDA multiple may actually be a by-product, for lack of a better term, of the deal price. Buyers and sellers examine the facts and circumstances surrounding the transaction, which may or may not include a discussion of EBITDA.

To illustrate the point that it is incorrect to use an EBITDA multiple as a standalone method for valuing a company, examine the following data of Company X, a privately held company whose shareholders desire to sell the business.

Company X has three-year average revenue of $8.4 million, an average gross profit margin of $1.1 million and average adjusted EBITDA of $500,000. The company’s three-year adjusted net income is $220,000, or 2.6% of average revenue. Company X’s average adjusted net cash flow is $150,000, which is the amount the equity shareholders can remove from the business without disrupting operations (similar to dividends). Based on the Capitalized Economic Income Method utilizing Company X’s average adjusted net cash flow of $150,000, the fair market value of the business is $1.09 million, including $230,000 of non-operating assets.

The Capitalized Economic Income Method is an income approach method, which is the appropriate approach to value a business as a growing concern. Transactional data is utilized only as a sanity check in a market approach methodology to validate the findings of the income approach. Research of stock transactions indicates that privately-held companies within the same industry as Company X sold for 0.3x revenue, 1.0x gross profit, and 8.5x EBITDA. Calculating these multiples by the company’s three-year average revenue, gross profit margin and EBITDA, respectively, indicates a wide range of values:

- Market Value based on revenue = $2.52 million.

- Market Value based on gross profit = $1.1 million.

- Market Value based on EBITDA = $4.25 million.

Leaving aside the statistical factors a valuation analyst must consider when analyzing transactional data, such as the coefficient of variation and standard deviation, the large difference in values calculated by the multiples corroborates the two important inadequacies: EBITDA is not an accurate calculation of a company’s net cash flow, and a standalone application of EBITDA inflates a company’s price and perceived value. Based on Company X’s revenue size, its after-tax net income and net cash flow are very low. Company X is underperforming in comparison to the industry, and therefore, Company X has a market value that is in the lower range. Does this mean that a purchase price based on the EBITDA multiple would over value the company? The simple answer is “yes,” however the right answer is “it depends.” Because, remember: value is determined theoretically, whereas the actual purchase price of a business is typically driven by the desires and needs of the buyer and seller.

A business valuation conducted by an objective third-party provides the M&A advisor a “starting point” when contemplating a company’s asking price as it represents a hypothetical buyer, hypothetical seller scenario in an all cash, all stock purchase. The independent valuation also fends off creative accounting tactics that can distort a company’s value. During negotiations, an EBITDA multiple may be part of the discussion but it should not be the focus. Nevertheless, market multiples, such as EBITDA, are useless unless serving only as a “sanity check” to value derived from sound valuation methodology and thorough analysis.

In Conclusion:

Despite all its apparent shortcomings, the usage of EBITDA vacillates from analyzing desperate companies with bad credit to serving as a favorite tool of naïve investors, lenders and M&A participants. Whether determining a company’s available cash flow or purchase price, an appropriate measure of earnings must be employed—clearly, EBITDA is not an appropriate standalone measure of either. These days, knowledgeable professionals in the M&A and finance industries consider a standalone application of EBITDA as “earnings before bad stuff”, “a lot of baloney”, “a vague measurement”, “one of the most flawed concepts to be adopted by the financial community”, and “a joke”.